How to Resolve Error - “Authentication failed at emas”

Table of Contents

GST Aadhaar Authentication Failed How to Solve

Sometimes while we are about to attach the DSC to file the return be it GSTR-3B, GSTR-1 or TRANS-1, the error message “Authentication has failed at emas. If error persists quote error number rt-3bas1031 when you contact customer care for quick resolution ” is displayed. This error "DSC authentication failed" will be resolved by updating the DSC. Let’s understand the resolution for the same and also about rt-3bas1031 GST error.

Next, we'll know how to solve DSC verification failed in e-procurement.

-

Go to My Profile

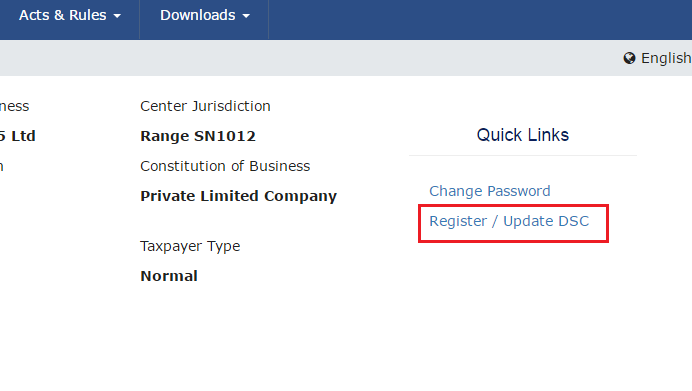

2. Click on Register/ Update DSC

3. The Register Digital Signature Certificate page is displayed. In the PAN of Authorized Signatory drop-down list, select the PAN of the authorized Signatory that you want to update and then authentication failed at emas eror comes.

4. Click the UPDATE

Note:

Before you update your DSC at the GST Portal, you need to install the em-Signer utility. The utility can be downloaded from the Register DSC page. DSC registration is PAN based and only Class 2 and Class 3 DSC are accepted at the GST Portal.

5. Click CONTINUE

6. Select the certificate. Click the Sign button.

7. A successful message that “DSC has been successfully updated" is displayed.

With the help of all the above steps, you will come to know about GST dsc error. So, now you can get solution over the error authentication failed for DSC. If your dsc is not registered with din on mca portal, so register it and verify.

Know Your GST | GST Calculator | GST Verification | GST Status | HSN Code | GST PAN

About the Author

I am a content and marketing manager at Masters India. I am also a tax and finance content writer. I also write academic books on accounts and tax. I have an experience of 7+ years in Income Tax Read more...

rajesh kumar