GSTR-3B Reset Process

GSTR-3B once filed, cannot be revised. However, the Central Board of Indirect Tax and Customs has enabled the ‘RESET’ option (how to reset submitted gstr 3b) for GSTR-3B which can simply reset GSTR 3b. This option will be activated once GSTR-3B is submitted. That means, the taxpayers have an option to reset their GSTR-3B after they have submitted it but before it is filed in case can we change GSTR 3b after submitting, GSTR 3b reset option not available.

Note: GSTR-3B is a summary return. How To Reset GSTR-3B? The details of total outward supplies (sales) and total inward supplies (purchases) made during a month are to be disclosed in this return. As mentioned above, this return once filed cannot be revised. It is essential to know that how to revise GSTR 3b after filed, many taxpayers wanted to know how to reset GSTR 3b after submission. We will help you to aware of how to gstr 3b revised return.

Features Of ‘Reset GSTR-3B’ Option

- This feature can be utilised when the GSTR-3B is submitted but not filed.

- Once the ‘Reset GSTR-3B’ option is selected, the status of the return will change to ‘Yet to be Filed’ from ‘Submitted’.

- When this option is selected, all the entries posted in the electronic liability register are deleted. Furthermore, ITC reflecting in the electronic credit ledger will be reversed.

- The option to rest GSTR-3B can be exercised only once.

How To Reset GSTR-3B?

Now, see how to amend GSTR 3b and how to activate reset button in GSTR-3b: In the next few steps, you'll get to know is asked how to revise GSTR-3b after filed 2022 or how do i reset GSTR 3b after submitting

- Step 1: Log in to the GST portal.

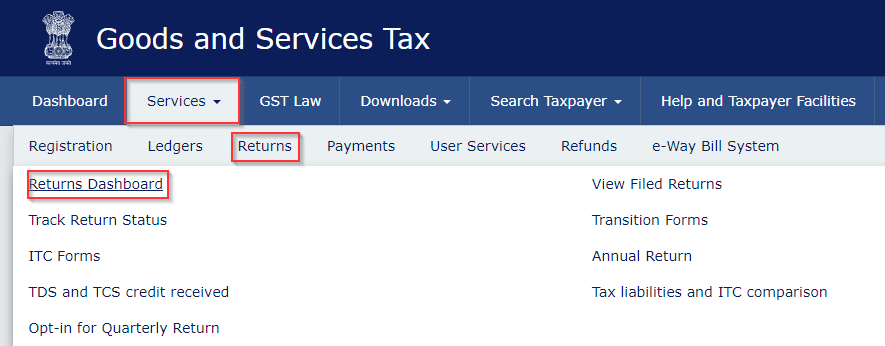

- Step 2: Under ‘Services’ select ‘Returns’ and then ‘Returns Dashboard’.

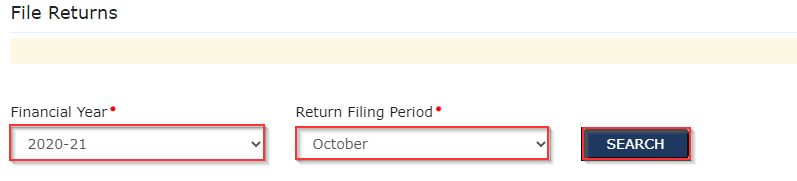

- Step 3: Select the ‘Financial Year’ and ‘Return Filing Period’.

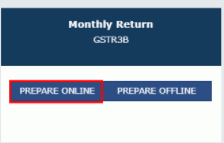

- Step 4: Click on ‘PREPARE ONLINE’ under ‘Monthly Return GSTR-3B’.

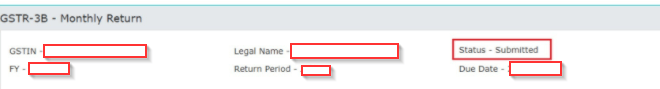

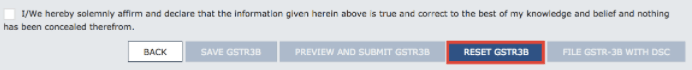

- Step 5: If the status of the GSTR-3B is ‘Submitted’ (how to change gstr 3b after submitting), the option to ‘RESET’ will be activated.

- Step 6: Reset GSTR-3B. Once the reset is successful, a ‘Success Message’ will appear on the screen and the status of the GSTR-3B will change to ‘Yet to be filed’.

- Step 7: Make the required changes in GSTR-3B and submit it again. Here's the process how to reset the submitted GSTR 3B.

So, if you think can GSTR 3b be revised amendment in GSTR 3B after filling, now you find the answer and revise easily by following above steps.

Need of GST In Points | GST Invoice Series Rules | Powers of Revisional Authority Under GST | Kaju GST Rate | Maintenance GST Rate

Frequently Asked Questions

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement