GST ADT 01

Section 65 of the GST Act empowers tax officers to undertake GST Audits. If the authorised officer believes that an audit is necessary for any taxpayer, he/she has the authority to issue a notice in FORM-GST-ADT-01. This form works as a notice for conducting audit u/s 65(3) (GST ADT-01). Furthermore, the officer will do the required groundwork and depending upon the records to be verified he/she will decide whether the audit is to be carried out at the business premises of the taxpayer or the office of the officer. The place at which the audit will be carried out will be stated in this notice. Here, we will discuss ADT 1 GST section 65(3) (GST ADT-01).

Contents Of GST ADT 01

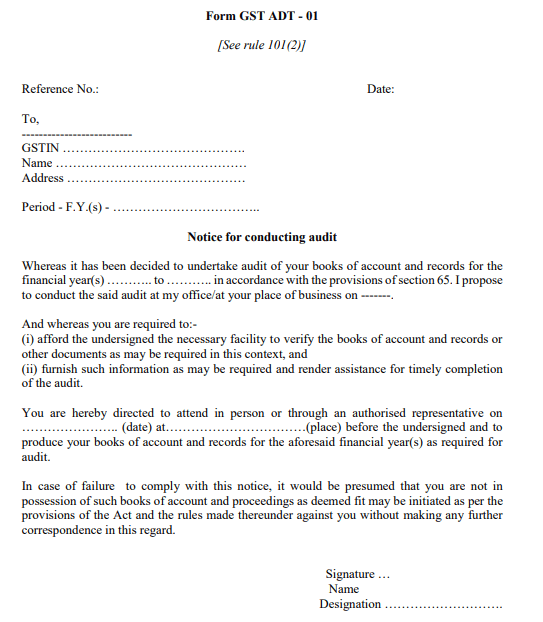

Form ADT 01 GST explicitly states the:

- Reference Number of the notice

- Date of the notice

- GSTIN, name and address of the taxpayer

- Financial Year (the period for which the notice is applicable)

- Scheduled date of the audit

- Location of the audit

- List of documents and records required to conduct the audit

- Date on which the documents and records have to be submitted (before the audit)

- Place at which the documents and records have to be submitted (before the audit)

Note: Usually, the notice clearly states the consequences of failure. In case there is a failure in complying with the elements of the notice, the officer will presume that the taxpayer is not in possession of the asked records and documents. The officer has the authority to proceed against the taxpayer as he/she deems fit (as per the provisions of the act and rules) without making any further correspondence to the taxpayer.

Format Of Form ADT-01 GST

See below the image of form GST ADT-01 in word format,

From the above image, you can understand the standard format of form ADT 1 under GST.

Note:

- The audit findings will be communicated to the taxpayer in Form GST-ADT-02.

- If the taxpayer accepts the audit findings, he/she can make the payment of tax, interest and penalty as calculated, via form GST-DRC-03. Once the taxpayer completes the payment, the audit proceeding will be closed, and the closure will be communicated to the taxpayer.

- However, if the taxpayer disputes the audit findings, the procedure for demand and recovery will be initiated.

Need of GST | New Invoice Series in GST | GST Inspector Power | GST On Dry Fruits | GST On Maintenance Charges

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement