Today everybody is busy in decoding the law of GST so that they can remain compliant and they don’t have to pay the interest or late fees unnecessarily. However, it is easier said than practically done. The law of GST is so confusing that most of the taxpayers are committing mistakes.

Let’s understand the GSTR 3B meaning and the mistake and its possible resolution in GSTR Form-3B.

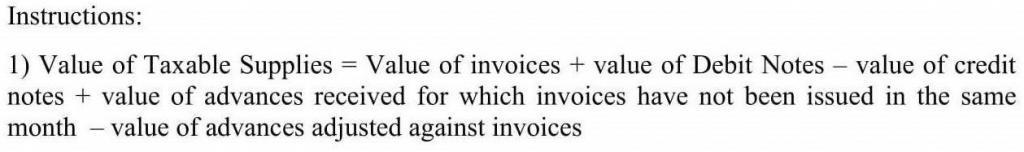

1.Column 3.1(a) requires the figures of Total Outward Taxable Supplies which includes value of all taxable invoices + value of all debit notes – value of credit notes + value of advances received – value of advance adjusted against invoices but few people are not taking it seriously and ignoring the debit/ credit notes and advances received.

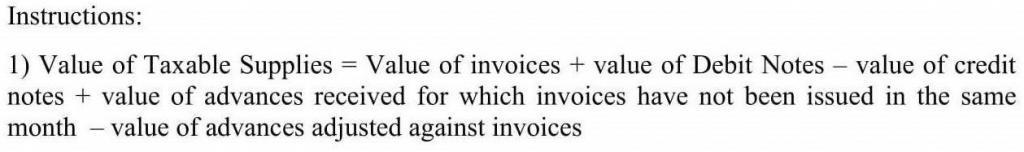

2. Column 3.1(b) requires zero rated supply means value of exports and supplies to SEZ unit or developer but few people are showing it in Column 3.1(c) which is for NIL Rated and exempt supplies. Under GST, exports are zero-rated. Here zero-rated does not mean that exports are taxed at ‘0%’. Rather it means that exports should be taxed not at all i.e. no tax on output and no tax on input .The main effect would not be on the output tax liability but it would definitely affect in claiming the ITC or Refund Claims and hence can be a disaster for the Exporters.

3. Details of Outward Supplies and inward supplies

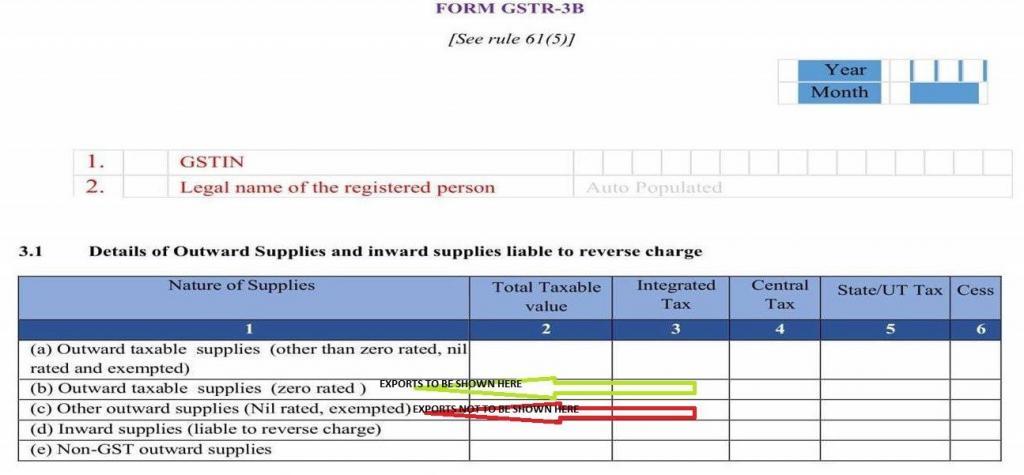

4. Inward supplies which are liable to reverse charge are to be shown in 3.1(d) and once paid in cash, the input tax credit can be claimed in column 4(A)(3) but many people are not showing the input tax credit value in column 4(A)(3) and hence this leads to accumulation of credit.

4. Inward supplies which are liable to reverse charge are to be shown in 3.1(d) and once paid in cash, the input tax credit can be claimed in column 4(A)(3) but many people are not showing the input tax credit value in column 4(A)(3) and hence this leads to accumulation of credit.

5.Input tax Credit on Purchases made during the current month has no specific column in TAB 4 and is required to be shown in Column 4(A)(5): All Other ITC, though it is a main heading.

6. Transitional Credit would come directly from TRANS-1 while setting off the Liability in FORM -3B. Transitional Credit cannot be claimed through Form –3B whereas it can be used while setting off the liability in payment of tax TAB 6. But many people aren’t aware of this fact and hence they apprehend about the claim of Transitional Credits.

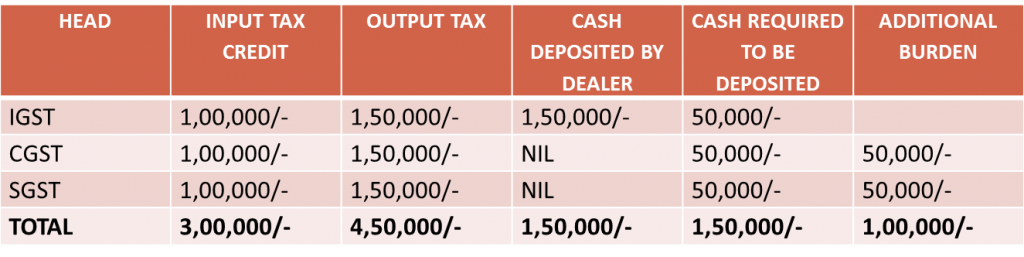

7. Liability of payment would be adjusted first against ITC as per applicable Prioritisation Rules and thereafter from cash ledger. Kindly note that as per the legal provisions of GST, the excess balance in electronic cash balance in one head cannot be utilized against any other head. This means that the electronic cash ledger do not permit inter-head set-off i.e. Cash deposit on a GST portal in a particular head can be utilised for payment against that particular head only. This further means that if I have a balance in cash ledger of IGST then that can be used to pay only IGST and can’t be used for payment of CGST or SGST. Due to this, the funds get blocked in electronic cash ledger which leads to shortage of working capital for the short duration of time and undue hardship for the taxpayers. So while creating a challan a cautious mind is required to deposit tax under the correct head.

Let us understand it through an example:

- If the taxpayer deposits Rs. 1,50,000/- as IGST considering that total input tax credit is Rs.3,00,000/- and total output tax liability is Rs.4,50,000/-then he is liable to deposit SGST Rs.50,000/- and CGST Rs. 50,000/- once again to set-off the liability lawfully according to cash deposit set off Rules.

- 1,00,000/- will be blocked under IGST head for payment for tax under IGST only for subsequent tax periods.

- So, from the above it is clear that cash payment to be made against particular head otherwise same cannot be adjusted against any other head and if deposited in wrong head then either set off will be against future liability under same head or claim refund of the wrongly deposited tax.

- Kindly not that the tax payment cannot be adjusted against interest and late fees. Interest and late fees are to be paid separately under “Interest” and “Late Fees” heads.

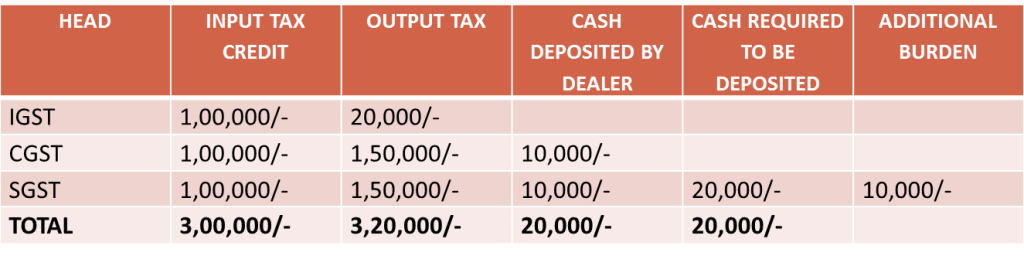

Let us take one more example to develop crystal clear clarity:

-

If the taxpayer deposits Rs. 20,000/- as IGST without applying prioritization rules and considering that total input tax credit is Rs.3,00,000/- and total output tax liability is Rs.3,20,000/- ,then he is liable to deposit SGST Rs.20,000/- once again to set-off the liability lawfully according to Prioritization Rules.

-

If he deposit Rs. 10,000/- as CGST and Rs.10,000/- as SGST then he is liable to deposit SGST Rs.10,000/- once again to set-off the liability lawfully according to Prioritization Rules.

8. Under GST law, if the registration is allotted then it is compulsory to file the GST return even if there is no turnover. If GST return is not filed for any month, then there is a late fine of Rs.200 per day subject to the highest maximum of Rs. 10,000/-, Rs.5,000/- under Central Act and Rs. 5,000/- under State Act. You can see that even if you do not earn even a single rupee, however, you forget to file the GST return, and then you shall incur heavy penalties.

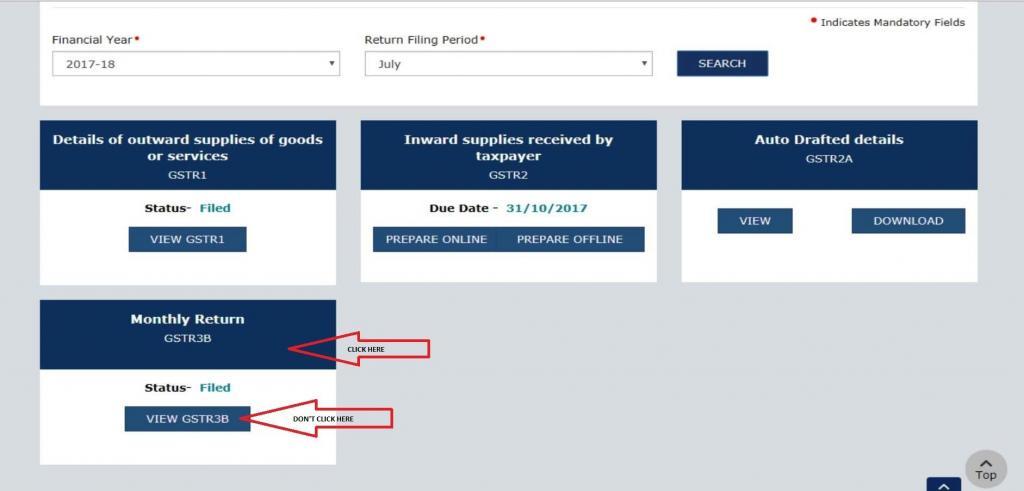

9. Another technical glitch on the GST Portal in Form-3B is that after submitting all the relevant details, if we click on the dark-blue area of the box then only we will be able to proceed for return filing by Digital Signature Certificate (DSC) or Electronic verification Code (EVC). Incase we click on VIEW GSTR-3B then an error message showing “ACCESS DENIED” is shown on the GST Portal.

10. In case you have already submitted TRAN-1 but not filed it, then in such a case you have to file the TRAN-1 first in order to be able to file your GSTR -3B. This is because we have used the transitional credit for the payment of output tax, so filing TRANS-1 through Digital Signature Certificate (DSC) or Electronic verification Code (EVC) becomes mandatory before filing the GSTR Form-3B. In case, we don’t file TRANS-1, an automatic reminder to file it before proceeding for FORM GSTR-3B will appear on the GST Portal.

11. In case we don’t click on “Generate Summary Button”, the GST Portal will not allow us to file a NIL GSTR FORM-3B. In order to file a NIL Form-3B, first click on “Generate Summary Button” at the bottom of the screen and then proceed to submit and file the Form-3B.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement