GSTR 2A and 3B Difference

Overlooking the comparison between GSTR 3B and GSTR 2A reconciliation in excel format may hamper the Input Tax Credit (ITC) you have claimed. Along with this, you can verify the claimed ITC during a relevant period. Moreover, GSTR-3B reconciliation format in excel before filing will help you to avoid show-cause notices from tax authorities. Here, we will explain GSTR 2A and 3B difference which help taxpayers to file the correct form of GSTR.

The following topics have been discussed in this article:

1. Comparison Between GSTR 3B and GSTR 2A

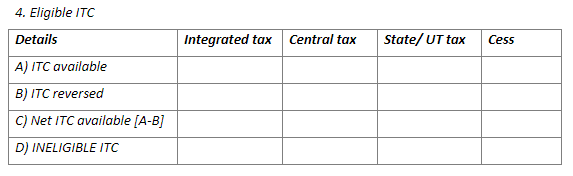

Under Goods and Services Tax (GST), GSTR 3B reconciliation and GSTR 2A both are GST return filing forms GSTR 2a vs GSTR 3b. Where form GSTR 3B is a self-declaration form used by the taxpayer. Further, GSTR 3B is a monthly summary return that is filed by the 20th of the month succeeding the one for which the return is being filed. ITC is made available to taxpayers depending on the details entered in Form GSTR 3B Table 4:

On the other side, Form GSTR 2A is an auto-populated GST Return that shows outward invoices entered by your suppliers. The details in GSTR 2A gets auto-filled by the Form GSTR 1 which is filed by your supplier disclosing monthly sales.

Under GST, ITC reconciliation between forms GSTR 3B and GSTR 2A or GST comparison sheet format in excel where comparisonbetween GSTR 3B and GSTR 2A is important for taxpayers. So, if you think what is the difference between GSTR 2a and GSTR 3b As the available ITC amount disclosed in GSTR 3B Table 4(a) is eligible after being reconciled as GST reconciliation format in excel and matched with the details of tax disclosed in GSTR 2A.

2. Importance of GSTR 3B & GSTR 2A Reconciliation

Reconciling GSTR 3B and GSTR 2A is important because:

- Notices in GST ASMT-10 Form have been issued by GST authorities to several taxpayers to reconcile claimed ITC in GSTR 3B with GSTR 2A. Either a reply from the taxpayer will be required or else he will have to pay the differential amount.

- Tax evaders have also been penalized for claiming ITC based on fake invoices

- Reconciliation makes sure that the claimed ITC is for the actually paid tax

- Errors, like missing an invoice or recording it more than once, are eliminated

- GST rectification in excel of errors committed in details disclosed in GSTR 1 or GSTR 3B is possible

- If outward supplies have not been recorded in GSTR 1 then it can be communicated to the supplier so that any discrepancy is eliminated

Further, annual return filing in GSTR 9 also requires ITC reconciliation according to GSTR 3b vs GSTR 2a in GSTR 9 Tables 6 and 8 across months. The GSTSR 2A and 3B reconciliation in excel format gives accurate and detailed reconciliation.

3. Reasons for GSTR 3B & GSTR 2A Non-reconciliation

In case the details reported in GSTR 3B and GSTR 2A do not reconcile, it may be due to the following reasons:

- ITC was claimed for IGST on imported goods and/or services

- ITC was claimed for GST paid on Reverse Charge Mechanism (RCM) basis

- Transitional credit was claimed in TRAN-I and II

- ITC was not availed in the financial year when goods and services were received

GSTR 2a and 3b reconciliation in excel in such cases will not be possible because a corresponding GSTR 1 will not have been filed for the same or ITC will not have been claimed in due time. The GSTR 2A and 3B reconciliation in excel format download on GST portal.

In case discrepancies related to the excess claim of ITC are found in GSTR 3B and GSTR 2A, then the taxpayer will have to pay the excess amount along with interest. Therefore, regularGSTR 2A and 3B reconciliation in excel and matching are important to ensure that only the correct amount of ITC is claimed by the taxpayer.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement