Know All About E-PAN Applicability

The recent introduction of e-PAN card aims at providing instant PAN allotment to new taxpayers. Here is everything you need to know about e-PAN and how to e-PAN apply for it.

The instant e pan, instant e pan card, instant pan card, e pan new and following topics have been discussed in this article:

1. About e-PAN

The Income Tax Department of India issued the Permanent Account Number (PAN) as a unique identification number for taxpayers. This 10-digit alpha-numeric code allows taxpayers to carry out financial transactions and helps the department to track transactions and ensure correct payment of taxes.

The e-PAN card is a recent introduction made by the Income Tax Department for instantly allotting PAN to new taxpayers. The number of applicants has been increasing at a growing rate. Therefore, the e-PAN card helps in catering to those applicants instantly. However, e-PAN cannot be issued to those taxpayers who already hold a PAN.

As of now, e-PAN is being issued to only individual taxpayers. E-PAN can be availed for free on a first-come-first-served basis because it is only made available for a limited time period.

2. Eligibility Criteria for e-PAN Application

The following criteria must be fulfilled in order to be eligible to apply e-PAN card:

- Applicant should be an Individual Taxpayer

- Applicant should be an Indian Resident

- Applicant should not be holding a PAN already

- Applicant should have an Aadhaar

- Applicant should have an Aadhaar-linked active mobile number

- Aadhaar details of the applicant should be updated and correct

3. Procedure for e-PAN Application

The following steps can be followed to e-PAN card apply for an e-PAN card:

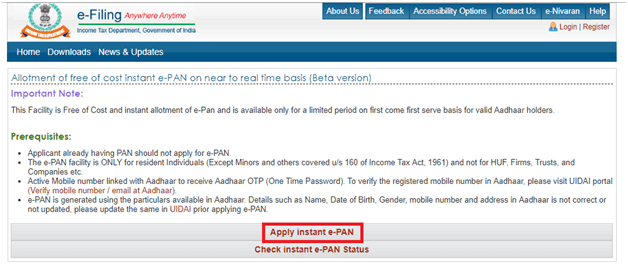

Step 1 – Go to the Income Tax e-Filing website of India

Step 2 – Click “Apply Instant e-PAN”

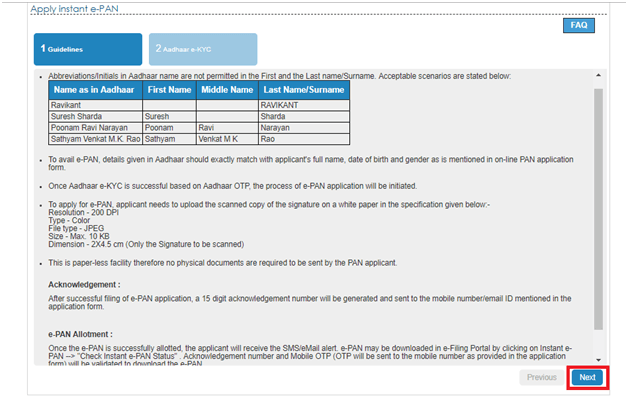

Step 3 – Go through the guidelines and click “Next”

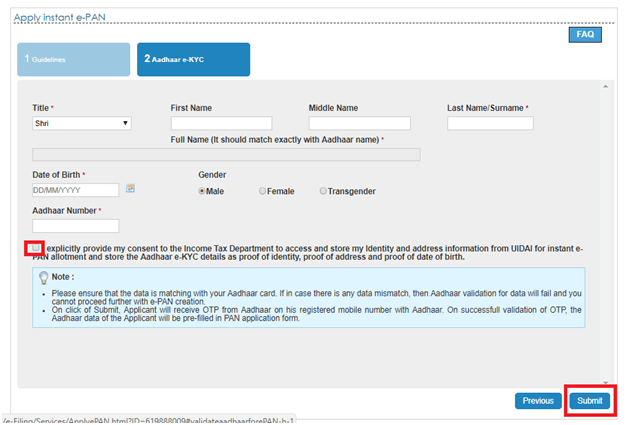

Step 4 – Enter details exactly as provided in the Aadhaar card. Tick on the acknowledgement box and click “Submit”

Step 5 – By submitting the application, the process for e-PAN application will be initiated. Applicant should upload a scanned image of their signature with the specifications: resolution – 200 DPI, type – color, file type – JPEG, size – maximum 10 KB, and dimensions – 2 x 4.5 cm.

Step 6 – After the scanned copy is attached, the application will be complete. A 15-digit acknowledgement number will be sent to your e-mail address or mobile number as mentioned in the application. An alert will be sent via SMS once the e-PAN is allotted.

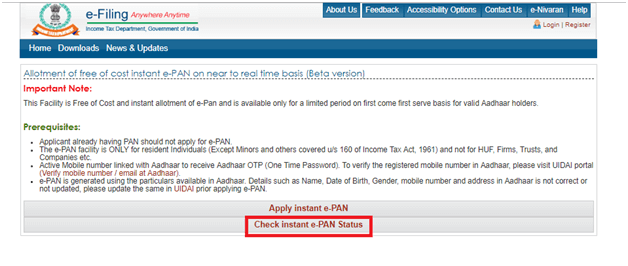

Step 7 – You can check the status of your e-PAN application by clicking “Check Application Status”.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement