Duplicate PAN Card Complete Details

A duplicate PAN card is a document which can be issued from the Income Tax Department by those individuals who are unable to access their original PAN card.

| Table of Contents |

| About Duplicate PAN Card |

| Filing for a Duplicate PAN Card Application |

| How to Apply for a Duplicate PAN Card? |

| Online Application |

| Offline Application |

| Surrendering Duplicate PAN Card |

1. About Duplicate PAN Card

Permanent Account Number (PAN) card is a mandatory document required to pay taxes in India. A PAN is a unique identification number which is allotted to individuals with a validity of a lifetime. PAN acts as the identity proof of Indian citizens and helps in carrying out numerous personal and business-related financial transactions throughout the nation. In case, the PAN card of an individual becomes inaccessible, s/he can apply for a duplicate PAN card.

A duplicate PAN card can be used in cases where the original PAN card has been lost, damaged, or misplaced. An application can be filed to the Income Tax Department which will then issue the duplicate document to the individual.

Situations in which an individual can apply for a duplicate PAN card are if the original document is:

- Lost or Stolen

- Misplaced and Forgotten

- Damaged or Destroyed: In case, the PAN card has been damaged, it can be reprinted if it is still in printable condition.

- Requiring Information Change: In case, the originally entered information in the PAN application has changed with time, it can be updated and the PAN card can be reprinted.

2. Filing for a Duplicate PAN Card Application

The authorized signatory for applying for a duplicate PAN card varies depending on the entity. Most taxpayer entities cannot apply for their own PAN card. They require an authorized signatory to do the same for them. The authorized signatories of different entities are as follows:

- Individual: An individual can file their PAN card applications themselves

- Company: A company requires any of its director(s) to file its PAN card application

- Hindu Undivided Family (HUF): An HUF requires any of its Karta to file its PAN card application

- Firm or Limited Liability Partnership (LLP): A firm or LLP requires any of its partner(s) to file its PAN card application

- AOP/BOI/Local Authority/Artificial Juridical Person: Their PAN card applications are to be filed by the authorized signatory mentioned in their deed.

3. How to Apply for a Duplicate PAN Card?

The application for a duplicate PAN card can be filed online and offline.

3.1 Online Application

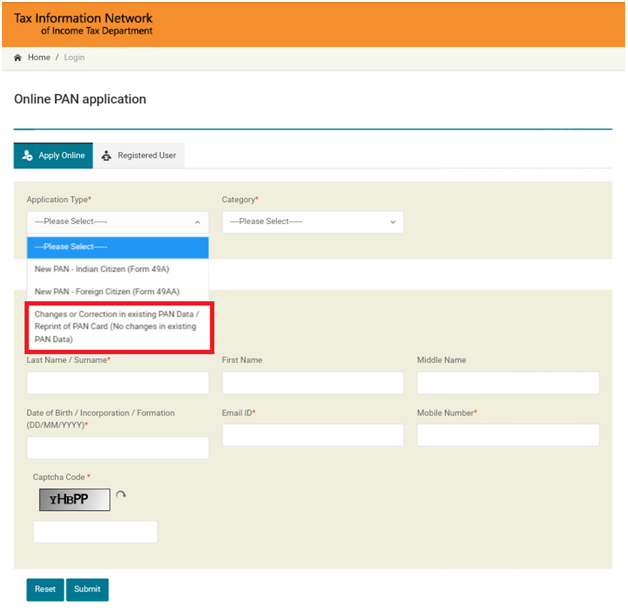

Step 1 – Go to the official PAN website TIN-NSDL

Step 2 – Select “Changes or Correction in Existing PAN Data/Reprint of PAN Card (No Changes in Existing PAN Data)”

Step 3 – Fill the required information and click “Submit”

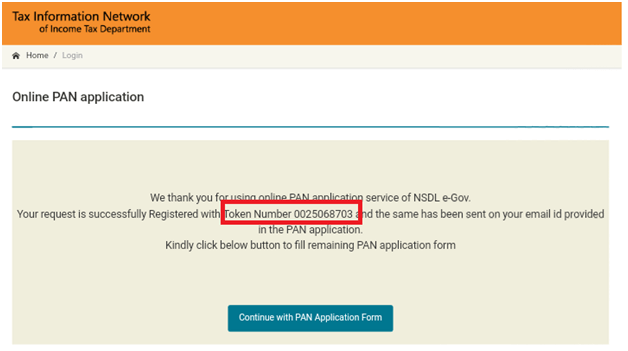

Step 4 – The e-mail id you entered will receive a token which should be noted for future reference. Continue filing the application

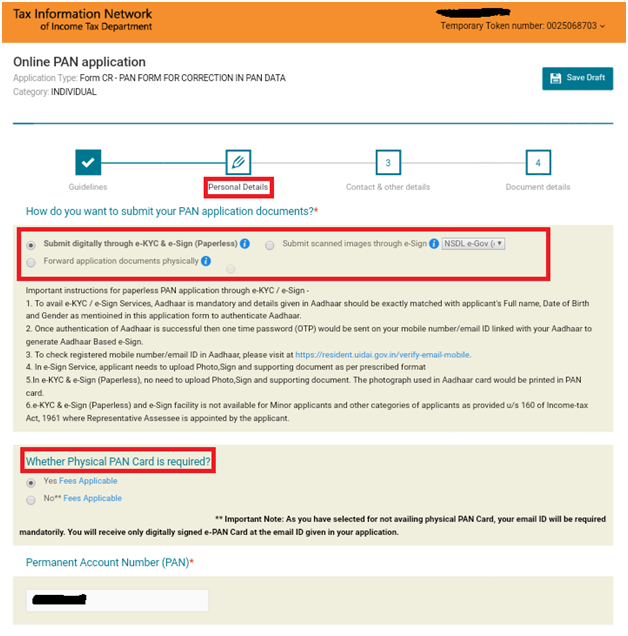

Step 5 – Fill the required “Personal Details” and select the mode of submission for your duplicate PAN card application:

- “Forward Application Documents Physically”: Here, the acknowledgement form will have to be printed after payment along with copies of required documents and will have to be mailed physically to the NSDL PAN Services Unit.

- “Submit Digitally Through e-KYC and e-Sign (Paperless)”: This option requires the Aadhaar of the person. The PAN card application should only be filled with details of the Aadhaar. There will be no need to upload scanned copies of photograph, signature, and other documents. Authenticate the details through OTP and submit the final form by e-signing it using digital signature certificate (DSC).

- “Submit Scanned Images Through e-Sign”: This option also requires the Aadhaar of the person. Scanned copies of photograph, signature, and other documents will be required to be uploaded, and the details of the application will have to be authenticated by OTP.

Step 6 – Select the type of PAN card you need (physical or electronic). A valid e-mail address will be required to avail an e-PAN card. The digitally signed e-PAN card will be sent to this e-mail id.

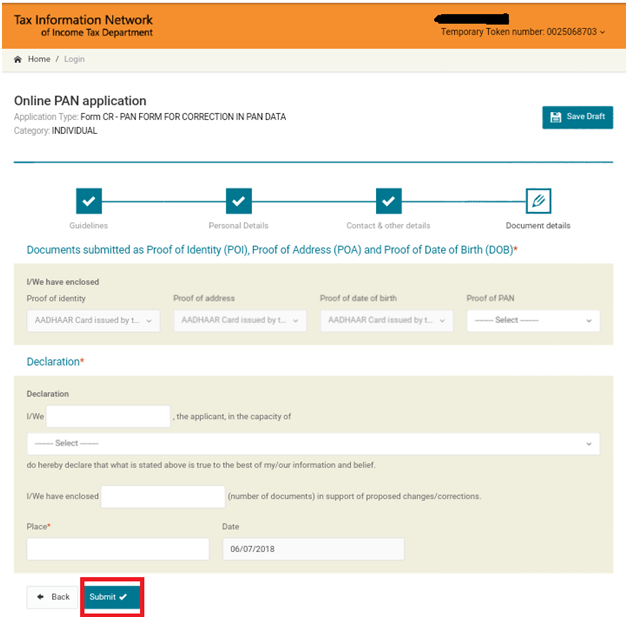

Step 7 – Fill in your “Contact & Other Details” including the “Document Details” and click “Submit”

Step 8 – Make the payment to generate the acknowledgement slip with a 15-digit number. Using the acknowledgement number, you will be able to check the status of your duplicate PAN card application.

The application fee for duplicate PAN card is Rs. 110 for resident Indians and Rs. 1,020 for non-resident Indians. The duplicate PAN card will be sent to you by the department within two weeks of receiving its application.

3.2 Offline Application

Step 1 – Download and Print the Form “Request for New PAN Card or/and Changes or Correction in PAN Data”

Step 2 – Fill the application using a black pen in BLOCK letters

Step 3 – Enter your PAN

Step 4 – Individual applicants are required to attach 2 of their passport sized photographs and cross-sign the photo without covering the face with the sign.

Step 5 – Fill the required details and sign the form

Step 6 – Attach the application with the documents of identity proof, payment, address proof, and PAN proof

Step 7 – Mail the application form along with the documents to the NSDL facilitation center

Step 8 – Once payment is completed, an acknowledgement slip with a 15-digit number will be generated and printed to you

Step 9 – Your application will then be sent to the NSDL PAN Services Unit for further processing

Step 10 – Using the acknowledgement number, you will be able to check the status of your duplicate PAN card application

The application fee for duplicate PAN card is Rs. 110 for resident Indians and Rs. 1,020 for non-resident Indians. The duplicate PAN card will be sent to you by the department within two weeks of receiving its application.

4. Surrendering Duplicate PAN Card

Having more than one PAN is not allowed under the Income Tax Law. There may still be cases where more than one PAN is issued to an individual. Such a case may require surrendering the incorrect or duplicate PAN to the Income Tax Department. The following steps can be followed to surrender a PAN:

Step 1 – Address a letter to the assessing officer by providing details such as full name, date of birth, PAN card details of the one you are retaining, and PAN card details of the one you are surrendering.

Step 2 – Speed post the letter or submit it to the assessing officer and receive an acknowledgement slip

Step 3 – This acknowledgement slip will act as a proof of cancellation of your duplicate PAN card.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement